The Best Guide To Contractors Insurance

Contractor insurance - Buildings Information System - NYC.gov Can Be Fun For Everyone

Hiscox Pros Tailor-made market bundles for building specialists Short-term liability policies offered Online quotes and instant protection Cons No online declares tracking Not available in Alaska Hiscox is a professional business insurance provider with around the world operations, serving consumers because 1901. They have an AM Finest ranking of A (Exceptional) and have insurance readily available all 50 states.

They offer all kinds of service insurance coverage for independent professionals, which you can get by calling one of their agents. Same-day protection might be readily available, which is really convenient. Hiscox can guarantee over 180 different professions, including architects, charm, contractors, IT specialists, landscapers, physical fitness, treatment, health home-services, and more. They use entrepreneur's policies, general liability, professional liability, cybersecurity, short-term liability, employees' compensation, umbrella, directors and officers, organization residential or commercial property, and employment practices liability.

Hiscox will supply tailored quotes online, and, as a baseline, they estimate that many small services can anticipate to pay $30 a month or less for basic liability, however expenses differ by area and organization requirements. We ran a quote for expert liability ($37 a month) and a company owner policy ($41 a month) and gotten a total premium of $78 a month with $1 million in liability coverage and a $500 deductible.

For instance, they provide plan policies for building general contractors that supply expert liability, professionals contamination, protective indemnity, and rectification as core protections. This package offers optional crime, cyber danger, general liability, and technology coverage. For IT professionals, the custom package includes software copyright and infringement protection as part of the standard policynot something a construction contractor is most likely to require, however essential for IT experts.

New License Classifications and Insurance requirements for Things To Know Before You Get This

They also provide deductible choices starting at $500 and as much as $10,000. Optional protection is offered, such as terrorism coverage, criminal offense, electronic information loss, and more. The business owner's policy excludes damages if you offer inaccurate information to clients. Also Found Here leaves out coverage for fraudulent acts, false advertising, and bodily injury.

This is perfect for those simply beginning out and developing a company with restricted budget plans.

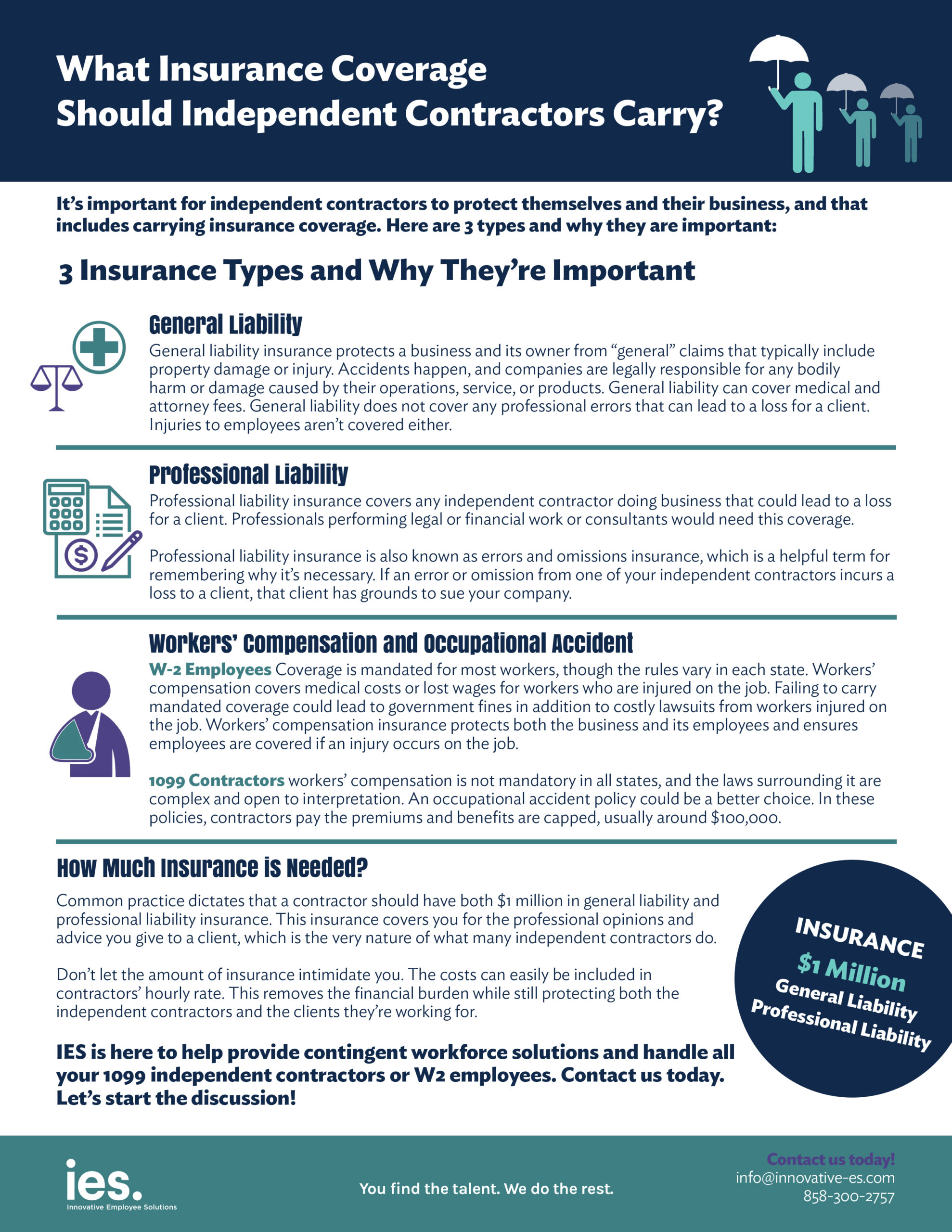

Professional liability insurance can assist safeguard your small company when something unanticipated takes place. This includes defense for your service' assets and staff members. Specialist liability coverage offers you peace of mind, understanding you have coverage when your organization deals with a lawsuit or covered loss. This means it is very important to understand the very best kinds of insurance coverage for contractors.

UNDER MAINTENANCE